Main Article Content

Abstract

The several criticisms toward the accountability of the govemment in term of tax policy either in its legislation, tax act or the implementation of tax legislation. There are many problems in this context, for instance unqualified human resources, the benefit of tax that not transparancy yet. Accountability that needed by society should be conducted by the government and constituted the rights of society to accept. The efforts that have been done by government to increase the accountability is still needs work hard and involving many parts of society so that be more efficiency and effectivity.

Article Details

License

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.

How to Cite

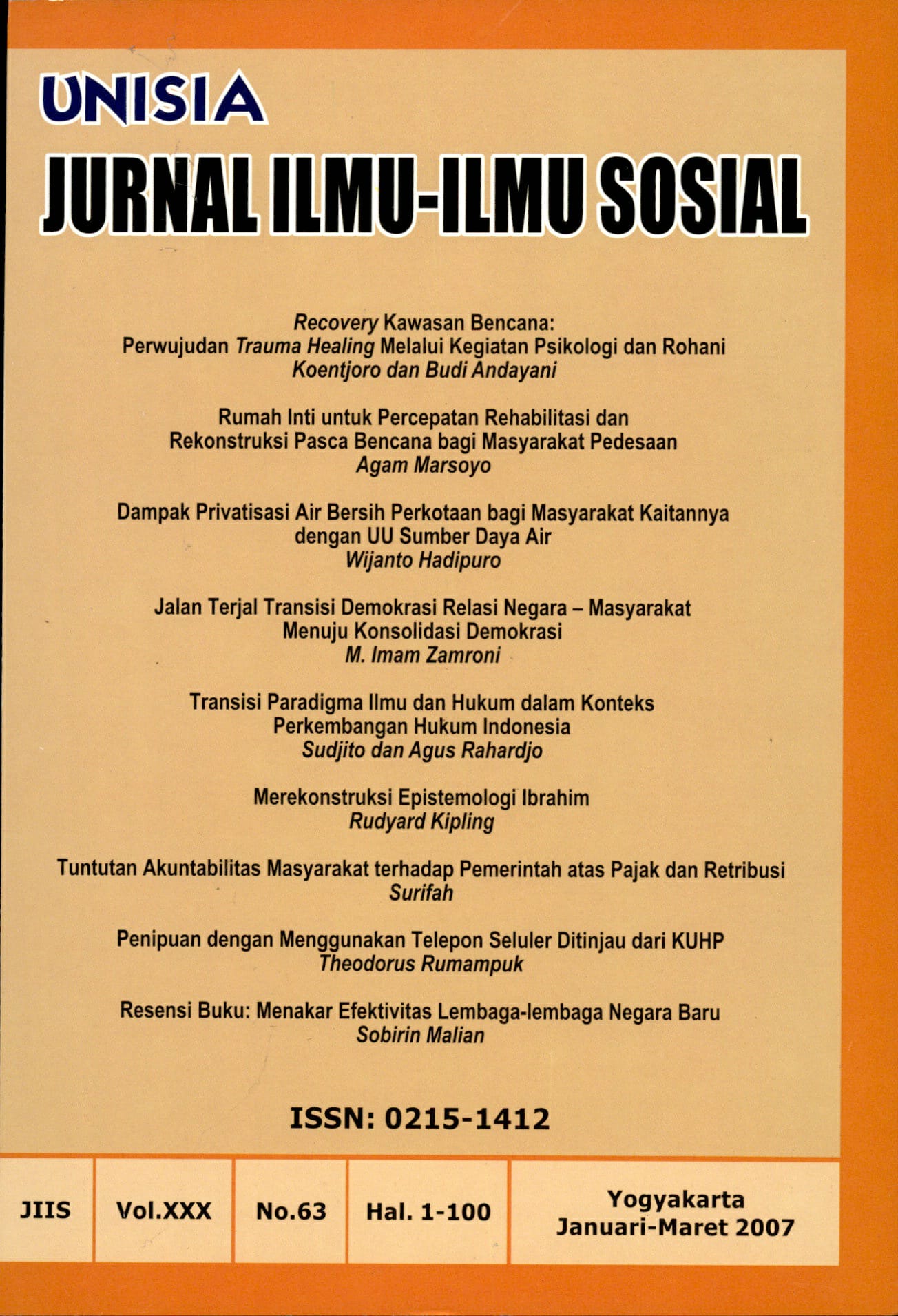

-, S. (2016). Tuntutan Akuntabilitas Masyarakat terhadap Pemerintah atas Pajak dan dan Retribusi. Unisia, (63), 74–80. https://doi.org/10.20885/unisia.vol30.iss63.art7