Journal Description

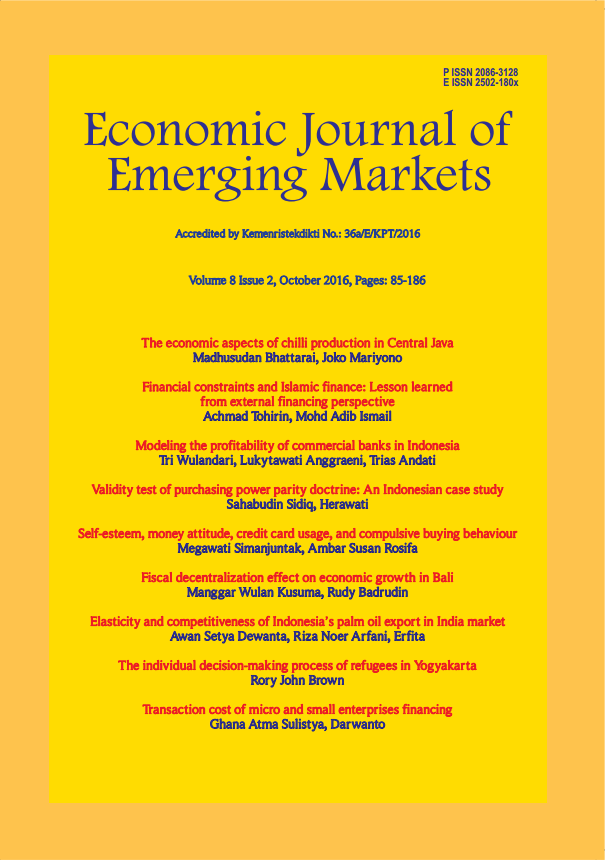

| Journal title: | Economic Journal of Emerging Markets |

| Journal initials: | EJEM |

| Abbreviation: | Econ. J. Emerg. Mark. |

| ISSN: | 2502-180X (online) | 2086-3128 (print) |

| DOI prefix: | 10.20885/ejem |

| Frequency: | Published in April and October |

| Journal history: | see Journal History |

| Indexing: | WOS and view more |

| Citation analysis: | Sinta Dimensions Google Scholar |

| Publisher: | Center for Economic Studies, Universitas Islam Indonesia, Yogyakarta, Indonesia |

Economic Journal of Emerging Markets (EJEM) is a peer-reviewed international journal that provides a scholarly forum for original research on economic issues and development challenges in emerging market economies. EJEM welcomes empirical and policy-oriented research papers that advance understanding of economic dynamics, structural transformation, financial systems, trade, industrial development, and socio-economic policy in emerging and developing countries. The journal publishes original quantitative research with high methodological rigor and policy relevance. It also encourages interdisciplinary approaches linking economics with development studies, finance, and public policy. EJEM particularly seeks to contribute to the global dialogue on economic development by offering a platform for both Indonesian and international authors to disseminate their scholarly work. Published twice a year (April and October), EJEM is fully open access for scholarly readers and aims to promote wide dissemination of knowledge in the field of emerging market economics. The journal was first published in 1993 as Jurnal Ekonomi (ISSN 0854-5723), then renamed Jurnal Ekonomi Pembangunan (JEP, ISSN 1410-2641) in 1996, and since 2009 has been published as the Economic Journal of Emerging Markets (EJEM, ISSN 2502-180X). The journal is published by the Center for Economic Studies, Faculty of Business and Economics, Universitas Islam Indonesia, Yogyakarta, Indonesia.

Current Issue

Volume 17 Issue 2, 2025

Published: October 29, 2025